Employee Benefits offer a way to:

However, benefits need to be valued by workers and aligned to wider business goals. To be valued the benefits need to be well communicated.

Given most employers contribute between 5%-15%* of annual salary on benefits, it’s important to get this right.

| Confirm required benefits and budget |

| Research market place |

| Implement |

| Communicate Value to Employees |

| Launch |

Every employer must put in place a workplace pension and make mandatory minimum contributions.

Many employers do more than the minimum that is required by law, and instead take the opportunity to show their employees how much they value them.

This offers a win-win situation where employers look to take advantage of improving the overall offering to their employees in a very tax efficient way and the employees enjoy the group benefits which offer far better value than purchasing individual benefits such as pensions, life insurance, healthcare etc…

| Workplace Pension |

| Private Medical Insurance |

| Group Life Cover |

| Group Income Protection |

| Group Critical Illness |

| Keyman Insurance |

| Relevant Life Trusts |

| Shareholder Protection |

| Executive / Manager Advice |

| Tax Advice |

| Pension Contribution Advice |

Ablestoke can guide you through these various benefit options to ensure that you end with what is right for you.

For example:

Ablestoke’s years and depth of experience will ensure the best guidance and advice possible.

Communicating the benefits you can provide and the value that they add is vital.

Ablestoke typically provide:

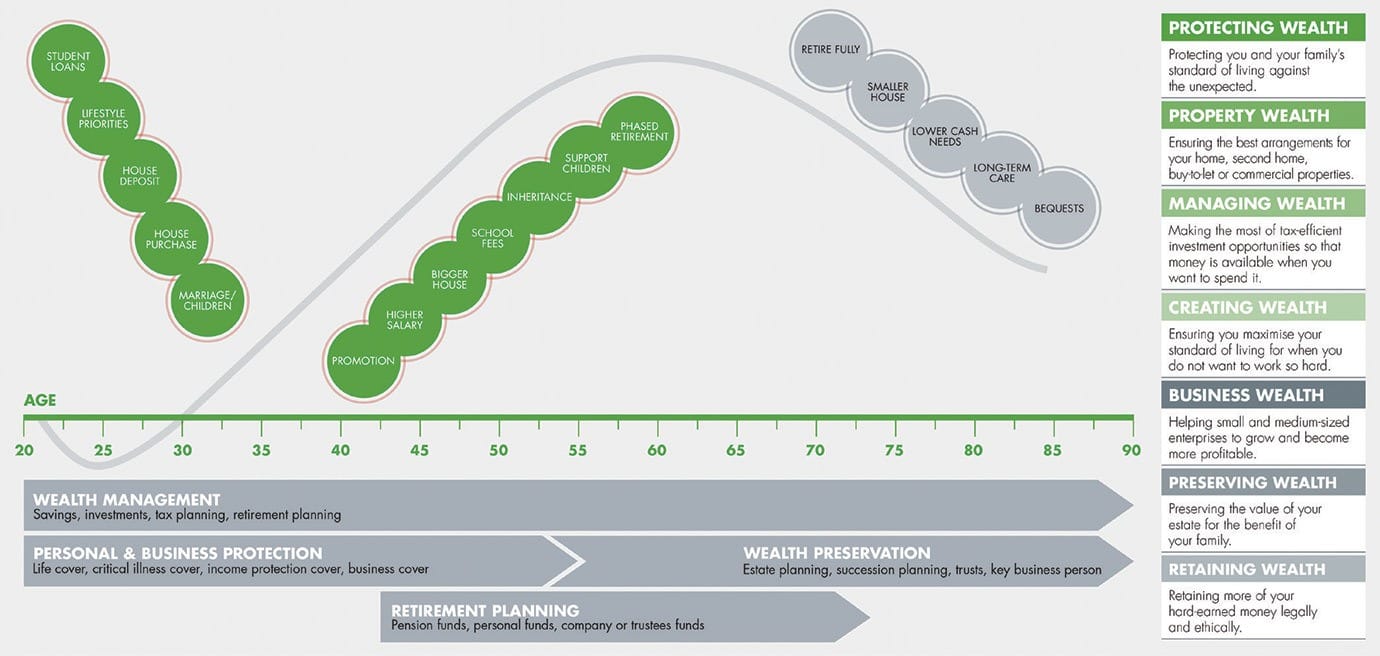

Ablestoke considers the individuals whole life and goals, not just their working financial life.

We continually strive to improve our professionalism through personal development.

We aim to provide a fully comprehensive service to all of our clients.

We are confident that we will deliver a high-quality service that will be among the best financial services industry.

We continually strive to improve our professionalism through personal development.

We follow the principles of Treating Customers Fairly set out by the Financial Conduct Authority.

If any material interest or conflict of interest should arise in business that we are arranging for you, we will let you know and ask for your consent before we carry out your instructions.

Our processes and procedures follow the guidelines as laid down by our business support network, which is authorised and regulated by the Financial Conduct Authority.

We like to treat our clients as we would expect to be treated. We like to hear how we’ve performed so please feel free to let us know. If you are ever dissatisfied with the service you’ve received we will do our best to put it right.

We choose to be part of Quilter Financial Planning, a network of more than 3,300 financial advisers looking after their clients’ interests throughout the UK.

Quilter Financial Planning is one of the leading financial advice networks in the UK, with a strong track record of delivering great customer solutions.

Quilter Financial Planning itself is part of Quilter, a company with real financial strength that offers long-term security for all its customers.

You can read more about Quilter Financial Planning and Quilter on the website: www.quilterfinancialplanning.co.uk

By clicking this link you are departing from the regulated site of Ablestoke Financial Planning LLP.

Neither Ablestoke Financial Planning LLP nor Quilter Financial Planning accept responsibility for the accuracy of the information contained with this site.

Open Link